The Grain Belt Express, the $4.9 billion Loan That Vanished, and Why the Lights May Dim Because of It

Washington killed the money.

In July, the Department of Energy quietly yanked its $4.9 billion loan guarantee for the Grain Belt Express—the 800-mile, 5-gigawatt high-voltage lifeline meant to drag America’s brittle grid into the 21st century. No press conference, no victory lap. Just a bureaucratic unplugging of the biggest transmission project in U.S. history.

And make no mistake: this wasn’t a minor brownout. This was a full-scale blackout.

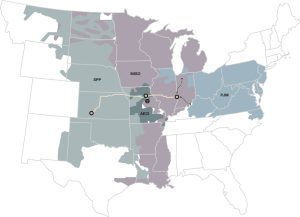

The Grain Belt Express (GBX), for folks who haven’t followed the saga, is the kind of project we used to brag about as a country. An interstate electric superhighway using HVDC—high-voltage direct current—to move massive amounts of power across four grid regions. Wind energy out of Kansas, solar out of Missouri and Illinois, firming support for the Midwest and the Mid-Atlantic. Think Hoover Dam energy ambition without the water.

There’s a reason engineers love this thing:

-

5 gigawatts of transmission capacity.

-

Enough juice for several million homes.

- Able to power 50 data centers

-

Long-distance efficiency that AC lines just can’t match.

-

The ability to push power across regions that normally operate like moody neighbors who never talk.

Now all of it is on life support.

Why Washington Walked Away

Why cancel the loan? The official explanations are wrapped in the usual government-speak: “risk concerns,” “market conditions,” “portfolio reassessment.” Unofficially, the politics are messier.

The Trump administration has staked out a very specific position on energy: more fossil fuel production, fewer federally-backed megaprojects that smell like the clean-energy transition. And while Grain Belt was never a “solar line,” its biggest backers were renewables developers, utilities needing stability, and regional grid planners.

So yes—this was political. Washington decided GBX wasn’t “America First” enough, even though it was being built by American contractors, using American steel, employing American workers, and solving a very American problem: a creaking power grid that fails when the first heatwave shows up.

That’s the part that should bother people. We’re not killing a green fantasy project; we’re undercutting grid reliability at the exact moment when:

-

Data centers are gobbling power like no tomorrow;

-

Electric vehicle adoption is climbing;

-

Extreme weather is hammering the grid;

-

And every politician wants “energy independence.”

You don’t get independence with 1970s transmission lines and wishful thinking.

What Happens Now?

For Invenergy, the developer, the cancellation is a nightmare. Losing a nearly $5 billion federal guarantee means turning to private equity markets, which are about as tender-hearted as a repo man on commission. Capital gets more expensive. Timelines slip. Conditions harden. The old Midwest joke applies: “You can do big things, just not cheaply or quickly.”

But the real losers aren’t the builders.

The losers are:

1. Farmers and landowners stuck in limbo

They’ve been negotiating easements for years. Now they’re asked to wait even longer for a project Washington pulled the rug out from under.

2. Grid operators already stretched to the breaking point

If you like rolling blackouts during heat waves, keep gutting big transmission lines.

3. States counting on cheaper electricity

GBX wasn’t charity—it was supposed to save ratepayers billions over 15 years by relieving congestion and allowing cheaper power to move freely.

4. National security planners

A fragmented grid is a vulnerable grid. HVDC lines like GBX make it harder for cyberattacks, equipment failures, or regional shortages to take down large sections of the country.

5. Anyone who likes the lights on

Our grid is running on borrowed time. We need more big, boring, unsexy infrastructure—not fewer.

This Isn’t About Left or Right. It’s About Up or Down.

Transmission isn’t culture war fodder. It’s plumbing. It either works or it doesn’t.

Canceling federal support for GBX won’t stop the project outright, but it shifts the risk onto ratepayers, delays construction, and sends a chilling message to every other developer thinking about building the next large-scale line:

Don’t bother unless you’re ready to finance NASA-level projects with lemonade-stand certainty.

We talk a lot about American greatness, American power, American grit. But greatness isn’t built on slogans. It’s built on steel, wire, concrete, sweat, and long-term commitments to the things that keep a country running—especially the parts nobody posts patriotic selfies about.

Grain Belt Express was one of those things.

Now it’s another example of how far behind we’re falling.

The Bottom Line

Washington didn’t just cancel a loan.

It canceled momentum.

It canceled reliability.

It canceled foresight.

It canceled the idea that the federal government is still willing to back big infrastructure the way it did with dams, highways, and rural electrification.

This wasn’t an accounting decision.

It was a national warning sign blinking red.